Buying a car can be an exciting yet challenging experience. To get the best deal, it’s essential to know what not to share with the salesperson. Here are 15 things you should never reveal at the car dealership to help you stay in control and drive away with a great deal.

Contents

Your Maximum Budget

Revealing your maximum budget can put you at a disadvantage because the salesperson may try to push you to the upper limit of your budget. Instead, keep this information private to have more room for negotiation and to prevent being steered toward pricier options.

How Much You Love the Car

Expressing how much you love a particular car can weaken your bargaining position. The salesperson might use your enthusiasm to justify a higher price, knowing you’re less likely to walk away from the deal.

Your Trade-In Value Expectations

Disclosing what you expect for your trade-in can lead the dealer to offer you less than your car’s actual value. Keep this figure to yourself and let the dealership make the first offer to potentially negotiate a better deal.

Your Monthly Payment Target

Focusing solely on monthly payments can lead to longer loan terms and higher overall costs. Dealers can manipulate financing terms to meet your monthly target while increasing the total amount you pay over time.

How Quickly You Need the Car

If you reveal that you urgently need a car, the salesperson might take advantage of your situation by offering fewer discounts or pushing for a quicker sale at a higher price.

Your Credit Score

Sharing your credit score gives the dealership an advantage in financing negotiations. They may offer you higher interest rates or less favorable loan terms based on this information, even if you qualify for better rates elsewhere.

Competing Offers You Have Received

Mentioning offers from other dealerships can backfire if the salesperson decides not to compete, thinking you’re bluffing. It’s better to keep this information private to maintain your negotiating power.

Your Current Car’s Condition

Downplaying or overemphasizing the condition of your current car can affect trade-in negotiations. Be honest but reserved about your car’s condition to avoid lowball offers or unnecessary scrutiny.

Any Immediate Need for Financing

Image Editorial Credit: Shutterstock.com

If the dealership knows you need financing immediately, they might offer less favorable loan terms. Keep your financing plans discreet to explore multiple options and secure the best rates.

Your Lack of Knowledge About Car Prices

Admitting that you’re unfamiliar with car prices can lead the dealer to take advantage of your inexperience. Research beforehand and project confidence to avoid overpaying.

Your Current Loan Payoff Amount

Revealing how much you owe on your current car loan can influence the dealership’s offer for your trade-in. They may offer less to cover the payoff amount, reducing your negotiating power.

The Amount of Down Payment You Can Make

Disclosing your down payment amount can affect the deal structure. If the dealer knows your maximum down payment, they might adjust the financing terms to benefit themselves rather than you.

Your Desire for a Specific Model or Color

Expressing a strong preference for a specific model or color can limit your negotiating options. Dealerships may hold firm on price if they know you’re set on a particular car.

Your Previous Car Shopping Experiences

Sharing details about previous car shopping experiences can give the dealer insights into your buying habits and preferences, which they can use to their advantage during negotiations.

Details About Your Job or Income

Providing information about your job or income can influence the dealership’s financing offers. They might tailor offers based on your perceived ability to pay, potentially leading to less favorable terms.

This article originally appeared in MyCarMakesNoise.

More from MyCarMakesNoise

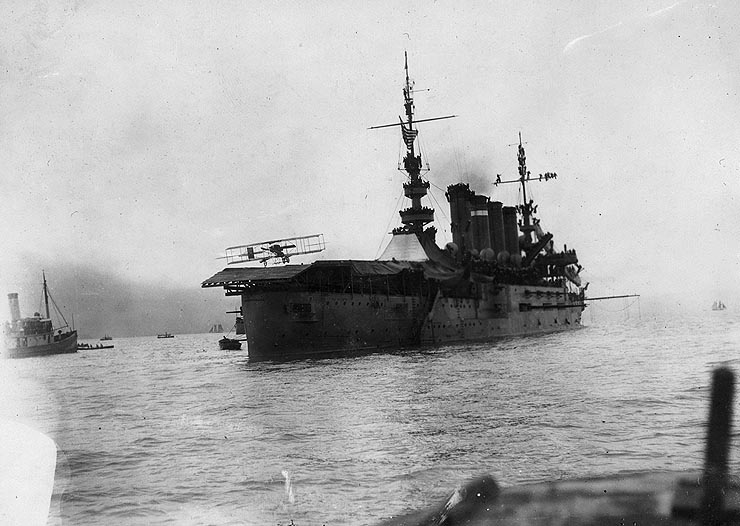

15 Key Developments in Naval Aircraft Through the Years

Naval aviation has played a crucial role in military history, evolving through numerous innovations and advancements. From the first successful aircraft carrier landing to the development of cutting-edge stealth technology, these key developments have shaped the capabilities of naval forces worldwide. Read More.

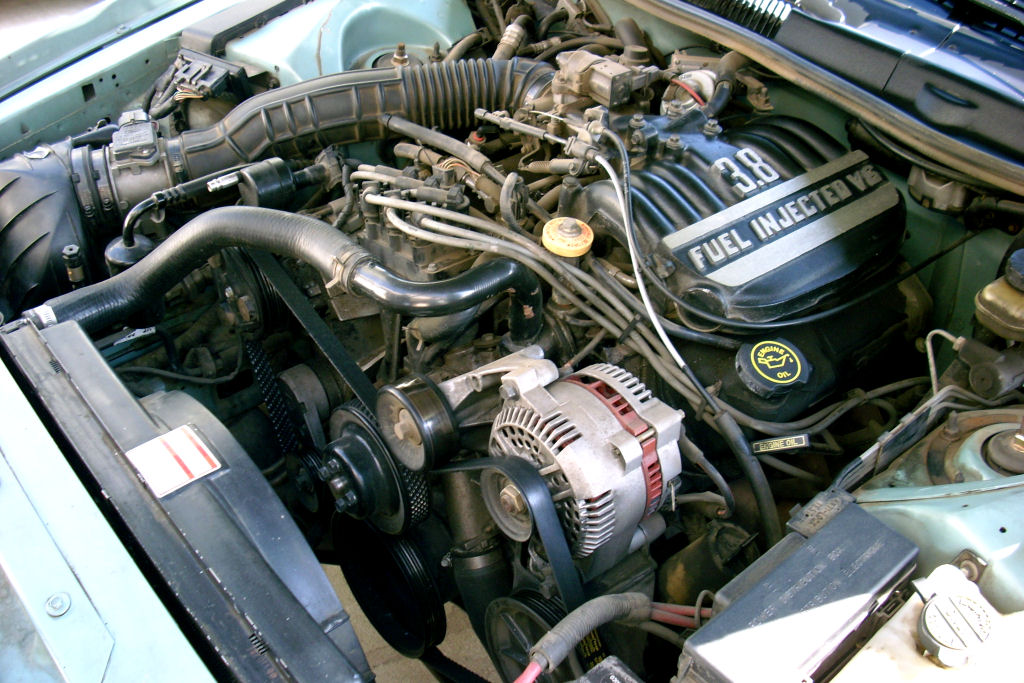

The 20 Worst Engines to Ever Power a Car

Some car engines are notorious for their high maintenance costs and frequent breakdowns. From the Cadillac V8-6-4 to the Volkswagen 2.0L TSI, these engines have faced numerous reliability issues, leading to costly repairs and owner frustration. Read More.

23 Luxury Electric and Hybrid Cars Leading the Market

As the automotive industry embraces the shift towards sustainability, luxury car manufacturers are leading the way with a stunning array of high-end electric and hybrid vehicles. Read More.