As electric cars continue to gain popularity, the oil industry is facing a range of new challenges. The shift towards cleaner energy and the growing demand for electric vehicles are reshaping the landscape, pushing the oil sector to adapt and innovate. In this article, we explore 15 key challenges the oil industry must confront in this rapidly evolving age of electric cars.

Contents

Declining Demand for Gasoline

The rise of electric vehicles (EVs) directly reduces the demand for gasoline, a primary product of crude oil. As more consumers switch to EVs for their lower operating costs and environmental benefits, oil companies face declining sales, particularly in the transportation sector, which has traditionally been a significant revenue stream for the industry.

Stranded Assets

As the world shifts towards electric mobility, investments in oil infrastructure, such as refineries and pipelines, may become obsolete. These assets, designed for a world reliant on fossil fuels, could lose value or require costly repurposing. This challenge threatens the financial stability of oil companies as they grapple with potentially billions of dollars in stranded investments.

Regulatory Pressure

Governments worldwide are implementing policies that favor renewable energy and impose penalties on fossil fuels, including carbon taxes and stricter emission standards. This regulatory landscape makes it increasingly difficult for the oil industry to operate profitably, pushing companies to adapt or face significant financial penalties.

Public Perception

The growing global awareness of climate change and environmental degradation has led to a negative public perception of the oil industry. Consumers are increasingly supporting cleaner energy alternatives, and this shift in sentiment is driving down demand for oil products, pressuring the industry to adopt more sustainable practices.

Competition from Renewable Energy

The rapid decline in the cost of renewable energy sources, such as solar and wind power, is challenging the oil industry’s dominance in the global energy market. As renewables become more economically viable, they capture a larger share of the energy market, reducing the demand for oil.

Carbon Emission Regulations

Stricter carbon emission standards, particularly in developed countries, are forcing the oil industry to reduce its greenhouse gas output. Complying with these regulations often requires significant investments in technology and infrastructure, increasing operational costs and squeezing profit margins.

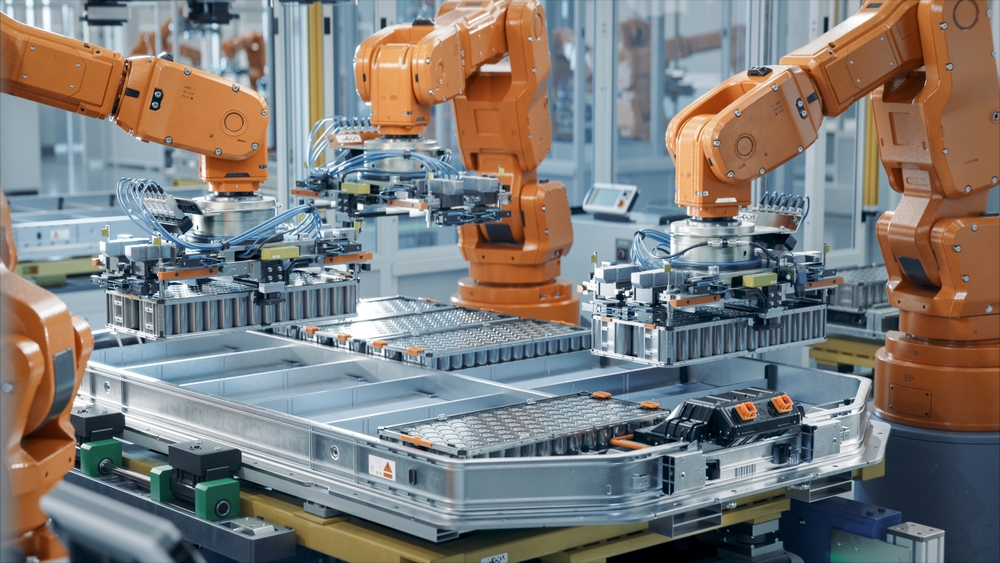

Technological Advancements in EVs

Continuous improvements in battery technology, such as higher energy density and faster charging times, are making EVs more appealing to consumers. As EVs become more efficient and affordable, the demand for oil, particularly for gasoline, diminishes, presenting a long-term threat to the industry.

Investment Shifts

Investors are increasingly moving their capital away from fossil fuels and towards renewable energy projects. This divestment trend reduces the availability of funding for oil exploration and production, forcing the industry to compete for a shrinking pool of financial resources, often at higher costs.

Oil Price Volatility

The transition to EVs could lead to greater oil price volatility as demand becomes less predictable. This unpredictability can cause significant challenges for oil companies in terms of planning and budgeting, as well as for countries that rely heavily on oil revenues.

Supply Chain Disruptions

The shift towards electric vehicles may disrupt supply chains for oil companies, particularly those involved in producing automotive fuels. As demand for these products declines, supply chains may need to be restructured, leading to potential inefficiencies and increased costs.

Infrastructure Adaptation Costs

As the demand for oil decreases, existing infrastructure, such as refineries and pipelines, may need to be adapted or repurposed. These modifications are costly and may not always be financially viable, putting additional strain on the industry’s resources.

Job Losses in Oil Sector

The contraction of the oil industry due to declining demand for fossil fuels could lead to significant job losses in exploration, refining, and distribution. These job losses can have widespread social and economic impacts, particularly in regions heavily dependent on the oil industry for employment.

Declining Export Markets

Countries that rely on oil exports for a significant portion of their income may struggle to sell their products as global demand decreases. This decline in demand could lead to economic instability in oil-exporting nations, forcing them to diversify their economies or face financial difficulties.

Increased Research and Development Costs

To remain competitive, oil companies may need to invest heavily in alternative energy sources and technologies. These research and development costs can be substantial, diverting funds from traditional oil exploration and production activities, and further straining the industry’s financial resources.

Energy Storage Competition

Advances in energy storage technologies, such as batteries for renewable energy, pose a significant challenge to the oil industry. As these storage solutions become more efficient and affordable, they reduce the need for oil-based energy generation, further eroding the demand for fossil fuels.

This article originally appeared in MyCarMakesNoise.

More from MyCarMakesNoise

25 Overlooked Electric Cars You Need to Know About

Electric cars are becoming more popular every year, but some great models often get overlooked. In this article, we’ll highlight 25 electric cars that deserve more attention. Read More

20 Pros and Cons of High-Performance Sports Cars

High-performance sports cars are a dream for many car enthusiasts, offering speed, style, and a thrilling driving experience. However, these powerful machines come with their own set of advantages and disadvantages. Read More

15 Hidden Costs of Owning an Exotic Sports Car You Need to Know

Owning an exotic sports car is a dream for many, but it’s important to be aware of the hidden costs that come with it. Beyond the hefty price tag, there are numerous expenses that can catch new owners off guard. Read More