Financing a car can feel overwhelming, but with the right approach, it doesn’t have to be. By taking a few key steps, you can secure the best deal and make the process smoother. Whether you’re buying new or used, these tips will help you navigate the financing process confidently. Here’s what you need to know to get started.

Contents

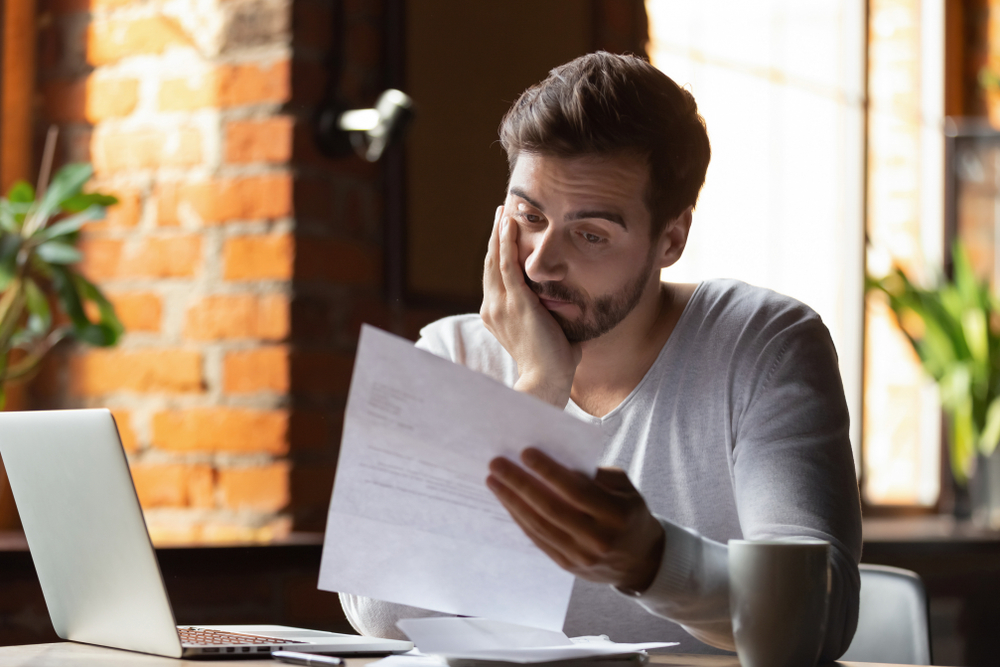

Evaluate Your Financial Situation

It’s important to assess your current financial standing before diving into the car-buying process. Take a close look at your income, existing debts, and monthly expenses to determine how much you can realistically afford. Knowing your financial limits helps set boundaries and avoids stretching yourself too thin with a high car payment.

Check Your Credit Report

Your credit score plays a significant role in securing favorable loan terms. Start by pulling your credit report from all three major credit bureaus—Experian, Equifax, and TransUnion. This gives you the opportunity to spot any errors or discrepancies that could negatively affect your score. Correcting these issues early on can improve your credit and qualify you for better interest rates, ultimately saving you money over the life of the loan.

Set a Budget

Before getting swept up in the excitement of car shopping, it’s crucial to establish a realistic budget. Factor in the cost of the car, along with monthly insurance premiums, maintenance expenses, and fuel costs. By sticking to a budget, you can avoid financial strain and ensure that the car payments fit within your monthly income. Remember, it’s not just about the price of the car but the total cost of ownership.

Determine Your Down Payment

A higher down payment can greatly reduce the amount you need to finance, resulting in lower monthly payments and interest costs. It’s recommended to aim for at least 20% of the car’s purchase price as a down payment. Doing so can help you secure better loan terms and reduce the risk of being upside down on the loan. A substantial down payment also demonstrates financial responsibility to lenders, giving you more bargaining power.

Decide on the Loan Term

Choosing the right loan term is a balancing act between monthly payments and total interest paid. While longer terms can make monthly payments more manageable, they often result in higher interest costs over time. Conversely, shorter loan terms will save you money on interest but come with higher payments. Carefully consider what works best for your financial situation and long-term goals before committing to a term.

Shop Around for Lenders

Different lenders offer varying interest rates and loan terms, so it’s in your best interest to shop around. Compare offers from banks, credit unions, and online lenders to find the most favorable terms. Preapproval from multiple lenders also strengthens your negotiating position when you arrive at the dealership. Exploring different options ensures you’re not settling for a subpar loan agreement.

Get Preapproved for a Loan

Securing preapproval for an auto loan gives you a clear picture of how much you can borrow and what interest rate you qualify for. This step not only streamlines the buying process but also shows dealerships that you’re a serious buyer. Having preapproval in hand can also prevent you from overextending your budget. It allows you to focus on finding the right car within your price range without worrying about financing surprises.

Research Incentives and Rebates

Car manufacturers and dealerships often provide special offers such as rebates or low-interest financing to attract buyers. These incentives can significantly reduce the overall cost of the vehicle. Make sure to ask about all available deals and whether you qualify for any promotions. Timing your purchase to coincide with these offers can provide additional savings and make the financing process smoother.

Consider Trading In Your Current Vehicle

If you have a car to trade in, this can be a great way to lower the amount you need to finance. The trade-in value can be used as part of your down payment, which reduces your overall loan balance. However, it’s important to research your current car’s value before going to the dealership to ensure you get a fair trade-in offer. Sometimes, selling your car privately may fetch a higher price, giving you more flexibility in your car purchase.

Review Loan Offers Carefully

Once you’ve gathered loan offers, it’s essential to review each one in detail. Pay attention to the APR (annual percentage rate), loan term, and any fees associated with the loan. Some lenders may offer enticingly low monthly payments but tack on higher fees or prepayment penalties. By thoroughly understanding each offer, you can make an informed decision and choose the one that best fits your financial needs.

Negotiate the Car Price Separately from Financing

To avoid confusion, it’s a good idea to negotiate the price of the car before discussing financing options. Dealers often try to combine the two to make the deal appear more attractive, but this can obscure the true cost. Focus on getting the best price for the vehicle first, and once that’s settled, move on to negotiating loan terms. This approach ensures you’re not overpaying for the car or the loan.

Understand Total Loan Cost

When considering a loan, it’s not enough to focus solely on the monthly payment; you must also account for the total loan cost over time. Interest rates and fees can add up, meaning a seemingly low monthly payment could end up costing more in the long run. Use an online loan calculator to determine how much you’ll actually pay over the life of the loan. This will help you make an informed decision that saves money in the end.

Consider GAP Insurance

Guaranteed Asset Protection (GAP) insurance is worth considering if you’re financing a large portion of your vehicle’s cost. It covers the difference between the car’s actual value and the amount you owe if your car is totaled or stolen. Since cars depreciate quickly, you could owe more than the car is worth during the first few years of ownership. GAP insurance provides peace of mind and prevents financial loss in such scenarios.

Evaluate Optional Add-Ons

Dealerships frequently offer additional services such as extended warranties or maintenance packages, but these add-ons come at a cost. While some may offer value, others can inflate the price of your loan unnecessarily. Before agreeing to any extras, assess whether they’re truly needed and whether you can find better deals elsewhere. Avoid allowing unnecessary add-ons to push your loan payments higher than anticipated.

Be Aware of Dealer Financing Tactics

Dealers often offer their own financing options, which can be convenient but aren’t always the best deal. Some dealerships mark up interest rates or include hidden fees to increase their profits. Always compare dealer financing with other loan offers to ensure you’re getting the best possible terms. Being aware of these tactics allows you to avoid unnecessary costs and stay in control of the financing process.

Consider Leasing as an Alternative

Leasing can be a great option if you prefer lower monthly payments and don’t mind not owning the car outright. With leasing, you essentially rent the vehicle for a few years and then return it at the end of the term. While this means you won’t have equity in the car, leasing allows you to drive a newer vehicle for less money.

Factor in Vehicle Depreciation

Depreciation is a crucial factor to consider when financing a car. Most vehicles lose value rapidly, especially in the first few years, which can leave you owing more than the car is worth. Being mindful of depreciation helps you make smarter choices about whether to buy new or used and how much to finance.

Don’t Rush the Process

Rushing into a car purchase without careful consideration can lead to costly mistakes. Take your time researching, comparing loan offers, and negotiating the best price. Impulsive decisions often result in higher payments, unfavorable terms, or buyer’s remorse. Patience in the car-buying process ensures you’re making sound financial choices that align with your long-term goals.

Finalize the Deal and Keep Records

Once you’ve agreed to a deal, make sure to carefully review all the paperwork before signing. Verify that the terms match what was discussed, and keep copies of all loan-related documents. Having these records on hand is essential for tracking payments and resolving any disputes. Proper documentation ensures you’re prepared for any issues that might arise during the loan term.

This article originally appeared in MyCarMakesNoise.

More from MyCarMakesNoise

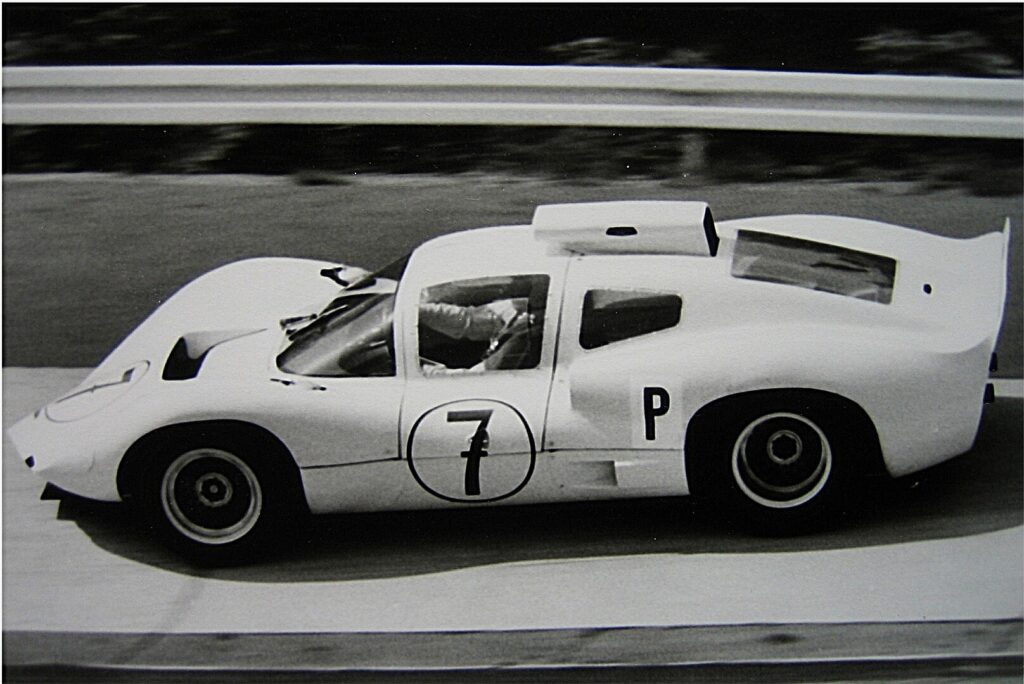

20 Legendary Race Cars That Faded into History

Some race cars leave an indelible mark on history, while others, despite their legendary status, quietly fade into the background. In this article, we’ll explore 20 of these remarkable machines—vehicles that once dominated the track but have since slipped out of the spotlight. Read More.

20 Historic Tractors That Are Still Plowing Strong

There’s something remarkable about a tractor that’s been working the fields for decades and still hasn’t lost its touch. These historic machines, built to last, have outlived their expected lifespans and continue to plow with the same strength as the day they rolled off the assembly line. Read More.

The World`s 18 Most Captivating Railroad Museums to Visit

Railroad museums offer a unique glimpse into the history and evolution of train travel, showcasing everything from vintage locomotives to intricate model railways. In this article, we will take you on a journey to discover the 18 most fascinating railroad museums around the world. Read More.