Buying a car can be an exciting experience, but it’s important to be aware of the tactics dealers use to inflate prices with unnecessary extras. From overpriced add-ons like window tinting and paint protection to inflated interest rates and hidden fees, these strategies can significantly increase the cost of your new vehicle. In this article, we highlight 20 sneaky tricks that dealers use and provide tips on how to avoid them. By staying informed and prepared, you can ensure you’re getting the best deal possible without falling for these common traps.

Contents

Add-On Extras

Dealers often include add-on extras such as window tinting, paint protection, and rust-proofing to inflate the car’s price. These services are usually marked up significantly compared to their actual cost. To avoid this, customers should review the invoice carefully and negotiate to remove or reduce the price of these extras. It’s also beneficial to shop around for these services separately to compare prices.

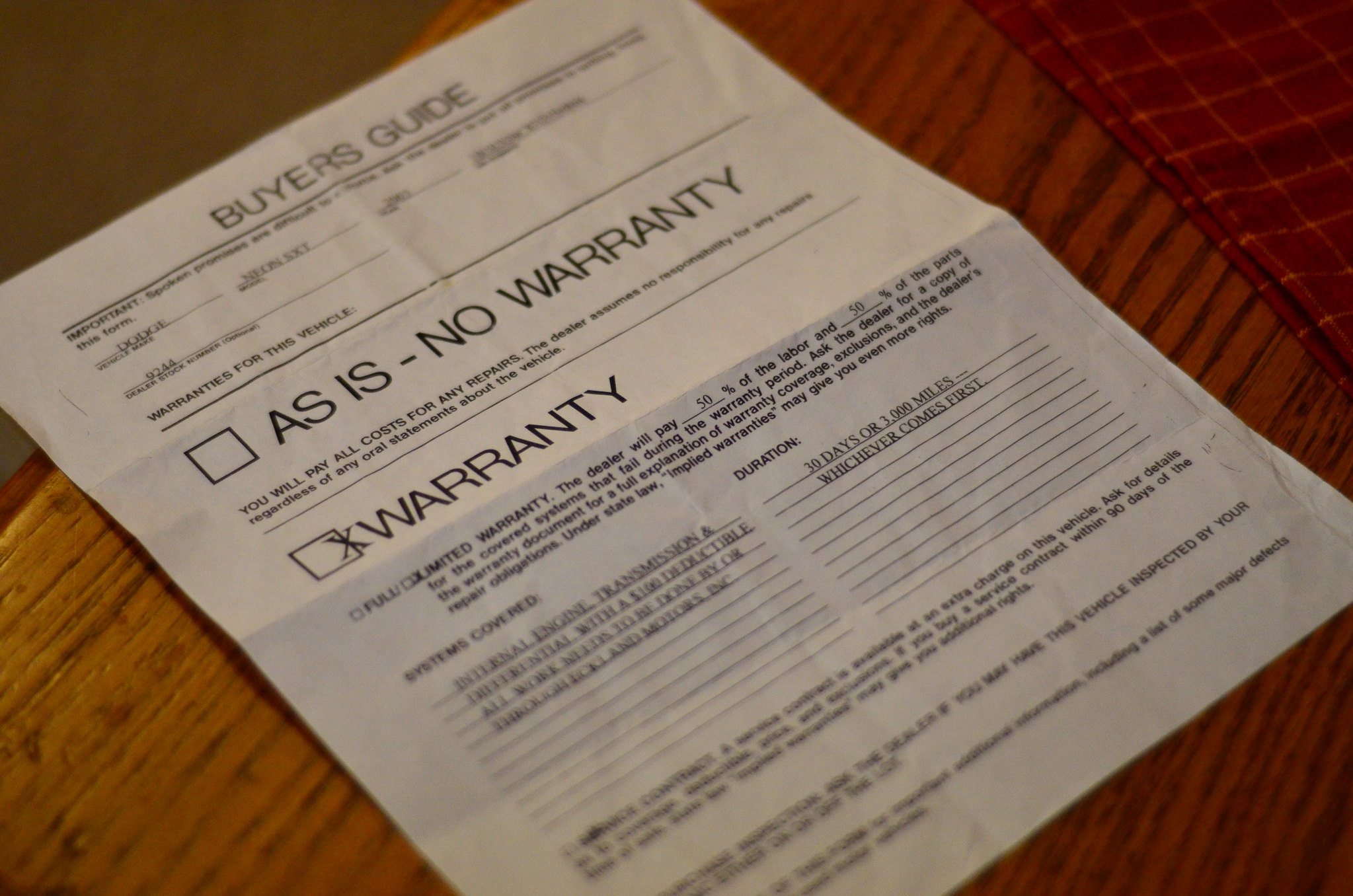

Extended Warranties

Extended warranties are another way dealers increase the final sale price. While they may offer peace of mind, the cost is often much higher than the value they provide. Customers should evaluate the terms of the warranty and consider if it’s necessary. Checking the vehicle’s reliability ratings and existing warranty coverage can help determine if an extended warranty is worth it.

Dealer Prep Fees

Dealer preparation fees are charges for cleaning and preparing the car for sale. These fees can be inflated or unnecessary. To avoid paying these fees, customers should ask for a detailed breakdown of what the fee covers and negotiate to have it removed. It’s important to note that basic preparation should be included in the car’s price.

VIN Etching

VIN etching is a service where the car’s vehicle identification number is etched onto the windows for security purposes. While it can be a useful theft deterrent, dealers often charge excessively for this service. Customers can opt to have VIN etching done independently for a fraction of the dealer’s price.

Fabric and Paint Protection Plans

Dealers often push fabric and paint protection plans that are overpriced and may not be necessary. These plans claim to protect the car’s interior and exterior but usually offer minimal benefits. Customers should assess if these protections are needed and consider using DIY products or third-party services for a lower cost.

Documentation Fees

Documentation fees cover the cost of processing paperwork but can be significantly marked up. To avoid overpaying, customers should ask for a breakdown of the fee and negotiate if it seems unreasonable. Knowing the average documentation fee in their state can also help customers identify excessive charges.

Market Adjustment Fees

Market adjustment fees are additional charges added when a car is in high demand. These fees can be several thousand dollars over the sticker price. Customers can avoid these fees by shopping at multiple dealerships, waiting for demand to decrease, or considering a different model with similar features.

Trade-In Value Manipulation

Dealers may offer a low trade-in value to offset a seemingly good deal on a new car. To avoid this, customers should research their trade-in’s market value using resources like Kelley Blue Book and get multiple trade-in quotes before negotiating with a dealer.

Low Monthly Payment Focus

Focusing on low monthly payments can lead to higher overall costs due to extended loan terms and increased interest payments. Customers should focus on the total cost of the car, including interest, and negotiate the price of the car first before discussing financing options.

High-Interest Financing

Dealers sometimes offer financing with higher interest rates than those available from banks or credit unions. Customers should secure pre-approval for a loan from their bank or credit union before visiting the dealership to compare offers and negotiate better terms.

Hidden Fees

Hidden fees such as advertising fees, fuel charges, and destination fees can inflate the final price. Customers should ask for an itemized list of all fees and challenge any that seem unnecessary or inflated. Understanding what fees are standard and which are added by the dealer can help in negotiations.

Payment Packing

Payment packing involves adding optional products like gap insurance or service contracts into the monthly payment without the customer’s explicit knowledge. Customers should carefully review all loan documents and ask for a breakdown of what’s included in their monthly payment to avoid hidden costs.

Yo-Yo Financing

Yo-yo financing occurs when a dealer allows a customer to take a car home before financing is finalized, then calls them back to renegotiate the loan terms at a higher rate. Customers should ensure that all financing paperwork is finalized and approved before taking the car off the lot.

Inflated Interest Rates

Dealers may inflate interest rates to increase their profit margin on financing deals. Customers should research current interest rates and shop around for the best loan terms before negotiating with the dealer. Pre-approval from a bank or credit union can provide leverage in negotiations.

False Urgency

Dealers often create a sense of urgency by claiming a deal or car is only available for a limited time. Customers should take their time to research and compare deals from multiple dealerships. Understanding the car’s true market value and availability can help counteract pressure tactics.

Monthly Payment Creep

Monthly payment creep occurs when additional costs are slowly added to the monthly payment amount without the customer noticing. Customers should keep track of the agreed-upon monthly payment and scrutinize any changes in the final paperwork. It’s crucial to verify the total cost before signing any agreements.

Rebates and Incentives Misrepresentation

Dealers may misrepresent available rebates and incentives, either by not applying them or by using them to offset their discount. Customers should research all manufacturer rebates and incentives independently and ensure they are correctly applied to the deal.

Lease End Charges

End-of-lease charges for excessive wear and tear or mileage overages can be unexpectedly high. Customers should carefully read the lease terms, understand the wear and tear policy, and maintain the car properly. Considering a pre-lease inspection can also help avoid surprises at the end of the lease term.

Overvalued Add-Ons

Dealers may sell overvalued add-ons like nitrogen-filled tires, upgraded floor mats, or aftermarket wheels at inflated prices. Customers should assess the actual value of these add-ons and decide if they are necessary. Often, these items can be purchased separately at a lower cost.

Prepaid Maintenance Plans

Prepaid maintenance plans are often sold at a premium, promising discounted or free maintenance services. Customers should compare the cost of the plan to the expected maintenance expenses and check if they are likely to use all the services included. It may be more cost-effective to pay for maintenance as needed.

This article originally appeared on MyCarMakesNoise.

More from MyCarMakesNoise

20 Overlooked Vintage Sports Cars That Are Hidden Gems

Many vintage sports cars have been overshadowed by more popular models, yet they possess unique qualities and charm that make them hidden gems. These overlooked classics often feature distinctive designs, impressive performance, and a rich history, offering great value to enthusiasts and collectors. Read More.

20 Experimental Racing Cars That Never Saw a Track

Experimental racing cars often push the boundaries of technology and design, yet many never make it to the track. These innovative vehicles showcase groundbreaking ideas but face challenges such as regulatory issues, funding problems, or technical difficulties that prevent them from competing. Read More.

20 Once-Popular SUVs That Have Lost Their Appeal

Once-popular SUVs have seen their appeal diminish over time due to various factors. Changes in consumer preferences, advancements in automotive technology, and increased competition have pushed these models into the background. Read More.