Leasing a vehicle can be a great option for those looking to drive a new car without the long-term commitment of buying. However, before signing any lease agreement, it’s important to understand the key factors that can impact your experience. From monthly payments to mileage limits, being informed will help you make the best decision. Here are 17 essential things to consider before leasing a vehicle.

Contents

Lease Term Length

The length of the lease is crucial because it determines how long you’ll be committed to the vehicle. Standard leases range from 24 to 48 months, with shorter leases often leading to higher monthly payments but more flexibility. On the other hand, longer leases may offer lower payments but require a longer commitment. Consider your future plans, as breaking a lease early can be costly. Evaluating your driving habits and lifestyle will help you choose the best lease term.

Monthly Payment

Leasing typically offers lower monthly payments compared to buying a vehicle. However, the exact amount you pay depends on factors like the car’s price, depreciation, and residual value. It’s essential to ensure the monthly payment fits comfortably within your budget. Keep in mind that additional costs, such as maintenance or insurance, may not be included. Carefully reviewing the payment terms helps avoid any financial strain.

Mileage Limits

Leases usually come with mileage limits, typically between 10,000 and 15,000 miles annually. Exceeding these limits can lead to expensive overage fees, sometimes charged at 15-30 cents per mile. If you have a long daily commute or love road trips, it’s wise to estimate your yearly mileage carefully. You might be able to negotiate a higher mileage limit upfront to avoid future costs. Planning ahead can save you from surprise fees at the lease’s end.

Residual Value

The residual value represents the car’s estimated worth at the end of the lease term. A higher residual value lowers your monthly payments since you’re only paying for the depreciation. If you plan to buy the car at the end of the lease, this value becomes your purchase price. Cars that retain their value well make for better leasing options.

Down Payment

Though leasing usually requires a smaller upfront payment than buying, a down payment can still reduce your monthly costs. Larger down payments lead to lower monthly payments but can increase financial risk if the vehicle is damaged or stolen early in the lease. Weigh the benefits of putting more money down versus keeping cash on hand. Some leases offer no down payment options, which may be appealing if you’re looking to minimize initial costs.

Early Termination Fees

Ending a lease early can result in hefty fees, making it important to assess your long-term commitment before signing. Life changes, such as moving or a shift in financial circumstances, could force you to end your lease prematurely. Be sure to check the lease agreement for early termination clauses, as the penalties can be substantial.

Vehicle Wear and Tear

Normal wear and tear is expected, but any damage beyond that may lead to extra charges when you return the vehicle. Leasing companies inspect the vehicle at the end of the term to assess its condition, and repairs for scratches, dents, or interior damage can be costly. Regular maintenance and care can help avoid penalties for excessive wear. Familiarize yourself with the leasing company’s definition of “normal” wear and tear before signing the agreement.

Lease Buyout Options

At the end of the lease, you may have the option to purchase the vehicle for its residual value. This can be a great option if the car’s market value exceeds the residual value or if you’ve grown attached to it. However, it’s essential to compare the buyout price to the vehicle’s current market worth before making a decision. Sometimes, the buyout price is not competitive, making it wiser to lease or buy a new vehicle. Keep this option in mind as your lease term approaches.

Insurance Requirements

Leased vehicles often come with stricter insurance requirements than owned cars, such as mandatory comprehensive and collision coverage. This can lead to higher premiums, so it’s important to factor these additional costs into your budget. Some leasing companies even require specific coverage limits, which may vary from state to state. To avoid any surprises, check with your insurance provider about how much your rates will increase.

Gap Insurance

Gap insurance protects you if your leased car is totaled or stolen, covering the difference between what the car is worth and what you still owe. Since cars depreciate rapidly, this difference can be significant, especially early in the lease. Some leasing companies include gap insurance in the contract, but if not, you can add it through your insurance provider. It’s a small price to pay for peace of mind. Without gap insurance, you could be stuck paying out of pocket for a vehicle you no longer have.

Lease Incentives

Leasing incentives, such as cashback or lower interest rates, can make leasing more attractive. These promotions are often offered by manufacturers to move vehicles faster, especially during end-of-year sales events. Taking advantage of such deals can save you money and make your lease more affordable. Be sure to shop around for the best offers and ask dealerships about current leasing specials. These incentives can lower your monthly payments or reduce your upfront costs.

Lease Return Condition

When returning your leased vehicle, it needs to be in good condition, free of excessive wear and tear. Leasing companies typically conduct a thorough inspection and charge for any necessary repairs. To avoid these charges, it’s a good idea to keep the car well-maintained throughout the lease term. Regular cleaning and minor fixes can go a long way in preventing unexpected costs. Make sure to return the vehicle in the condition outlined in your lease agreement.

Customization Restrictions

Leasing a car often comes with strict rules regarding modifications. Many companies prohibit alterations, such as adding new rims or aftermarket accessories, as the vehicle must be returned in its original condition. Violating these terms could lead to additional fees when you return the car. If you enjoy personalizing your vehicles, leasing might not be the best option for you.

Sales Tax and Fees

When leasing, you’re only taxed on the portion of the vehicle you use, which can reduce your upfront costs compared to buying. However, additional fees such as acquisition and disposition fees are common in lease contracts. These fees can add hundreds or even thousands of dollars to your total cost, so it’s important to understand what they include. Negotiating these fees can sometimes lead to savings. Always ask for a detailed breakdown of all taxes and fees before signing the contract.

Credit Score

Your credit score will significantly influence the terms of your lease, including the interest rate and monthly payment. A higher credit score generally results in better terms, while a lower score may lead to higher payments or difficulty securing a lease. If your credit score needs improvement, working on it before leasing can help you secure more favorable terms. Most leasing companies have minimum credit score requirements, so checking this ahead of time is essential.

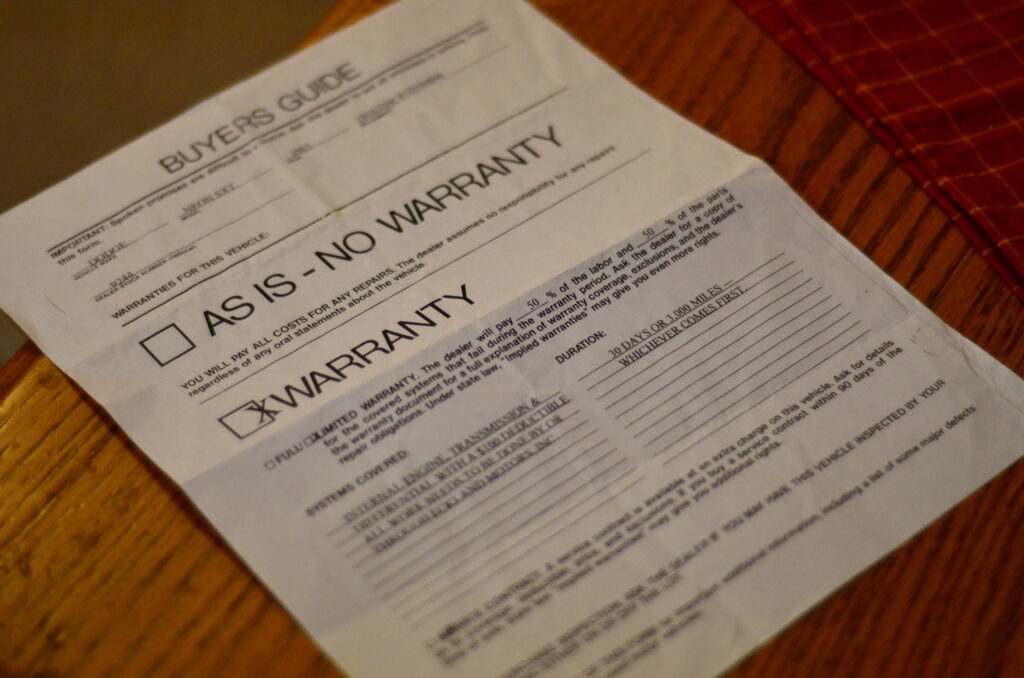

Manufacturer’s Warranty

Leasing within the vehicle’s manufacturer warranty period ensures that most major repairs are covered, reducing your financial burden. However, you should verify what the warranty covers and if any additional protection is needed. Some leases allow for extended warranties, which can provide peace of mind as the lease progresses. Be sure to understand the terms of the warranty, especially if you’re leasing for an extended period. A strong warranty can help avoid unexpected repair costs.

Driving Habits

Your driving habits play a significant role in determining whether leasing is a good fit. If you tend to drive long distances or on rough terrain, a lease might not be ideal due to mileage limits and wear-and-tear charges. Alternatively, if you prefer to drive a new car every few years and don’t rack up too many miles, leasing can be a cost-effective option. Understanding how your lifestyle aligns with leasing terms will help you make the right decision.

This article originally appeared on MyCarMakesNoise.

More from MyCarMakesNoise

The World’s 25 Most Bustling Airports and Their Unique Highlights

Air travel has become an integral part of our globalized world, connecting people and places like never before. Some airports stand out due to the sheer volume of passengers and flights they handle daily. Read More.

15 Exclusive Custom Vans Gaining Popularity Among Collectors

In recent years, custom vans have seen a surge in popularity among collectors. These unique vehicles, often tailored to meet specific tastes and needs, combine practicality with style. Read More.

16 Fun Facts You Didn’t Know About the Jeep Wrangler

The Jeep Wrangler is an icon in the world of off-roading and adventure. Its rugged design and unparalleled performance have made it a favorite among enthusiasts and everyday drivers alike. Read More.